Being forced to pay for expensive auto insurance premiums can eat up your monthly budget and maybe even restrict other spending. Performing a rate comparison is an excellent way to make ends meet.

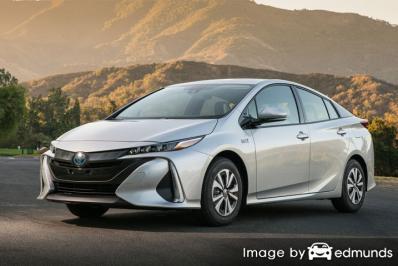

Unbelievable but true, almost 70% of insureds in Ohio have stayed with the same insurance company for four years or more, and just short of a majority have never quoted auto insurance rates at all. The average driver in the U.S. could pocket up to 46.5% a year by just comparing rate quotes, but they just don’t understand the actual amount they would save if they switched to a more affordable policy. Due to the increasing number of choices for buying cheap insurance for a Toyota Prius Prime in Cincinnati, it’s nearly impossible to locate the lowest cost company.

Unbelievable but true, almost 70% of insureds in Ohio have stayed with the same insurance company for four years or more, and just short of a majority have never quoted auto insurance rates at all. The average driver in the U.S. could pocket up to 46.5% a year by just comparing rate quotes, but they just don’t understand the actual amount they would save if they switched to a more affordable policy. Due to the increasing number of choices for buying cheap insurance for a Toyota Prius Prime in Cincinnati, it’s nearly impossible to locate the lowest cost company.

It’s smart to compare prices every six months since prices change regularly. Just because you had the lowest quotes on Toyota Prius Prime insurance in Cincinnati last year other companies may now be cheaper. There is a lot of bad information regarding Prius Prime insurance on the web, but in just a couple of minutes you can learn some solid techniques on how to buy auto insurance cheaper in Cincinnati.

The intent of this article is to help educate you on how auto insurance companies operate and some tips to save money. If you already have coverage, you will definitely be able to get lower rates using this information. Smart buyers only need to know the fastest way to compare rates from many different companies.

The fastest way that we advise to get policy rate comparisons for Toyota Prius Prime insurance in Cincinnati is to know the fact car insurance companies participate in online systems to compare rate quotes. The only thing you need to do is give the companies some data including whether or not you need a SR-22, the year, make and model of vehicles, how much school you completed, and whether you are single or married. That rating data gets transmitted to many highly-rated insurers and they return rate quotes instantly to find the best rate.

To compare lower-cost Toyota Prius Prime insurance rates now, click here and find out if you can get cheaper insurance in Cincinnati.

The car insurance companies shown below provide price quotes in Cincinnati, OH. To buy cheap auto insurance in Cincinnati, we suggest you get prices from several of them to get a more complete price comparison.

Choosing vehicle insurance is an important decision

Despite the potentially high cost of Toyota Prius Prime insurance, insuring your vehicle is required in Ohio but also provides important benefits.

- Almost all states have minimum liability requirements which means the state requires specific minimum amounts of liability protection in order to get the vehicle licensed. In Ohio these limits are 25/50/25 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If you bought your vehicle with a loan, almost every bank will make it mandatory that you have physical damage coverage to ensure the loan is repaid in case of a total loss. If you cancel or allow the policy to lapse, the lender will be forced to insure your Toyota at a much higher rate and force you to reimburse them much more than you were paying before.

- Car insurance protects not only your car but also your financial assets. Insurance will pay for medical expenses for not only you but also any passengers injured in an accident. Liability coverage, the one required by state law, will also pay for a defense attorney if someone files suit against you as the result of an accident. If your vehicle suffers damage from an accident or hail, collision and comprehensive coverages will cover the damage repairs after a deductible is paid.

The benefits of insuring your Prius Prime definitely exceed the cost, especially for larger claims. Today the average American driver is overpaying over $865 each year so compare rate quotes each time the policy renews to help ensure money is not being wasted.

Learn How to Find Car Insurance for Less

Many different elements are taken into consideration when you get your auto insurance bill. Some are pretty understandable such as your driving history, although others are less obvious like your vehicle usage or how safe your car is.

The following are a few of the “ingredients” companies use to determine your premiums.

- Gender is a factor – Over the last 30 years, statistics show that men are more aggressive behind the wheel. The data does not necessarily mean that men are worse drivers. Both genders get in at-fault accidents in similar percentages, but the men get into accidents with more damage. Men also get cited for more serious violations such as reckless driving.

- Pay less with a high safety rating – Cars with high safety ratings tend to be cheaper to insure. These vehicles reduce injuries and lower injury rates translates into fewer and smaller insurance claims and cheaper rates on your policy. If your Toyota Prius Prime scored better than an “acceptable” rating on the Insurance Institute for Highway Safety website or four stars on the National Highway Traffic Safety Administration website you may be receiving a better rate.

- Don’t skimp on liability protection – Your car insurance policy’s liability coverage kicks in in the event that a court rules you are at fault for damages caused by your negligence. Your liability coverage provides you with a defense in court starting from day one. This coverage is relatively inexpensive when compared with rates for comp and collision, so drivers should make sure they buy enough to cover all assets.

- No car insurance policy gaps is important – Allowing your coverage to lapse can be a fast way to bump up your car insurance costs. In addition to paying higher premiums, getting caught without coverage might get you fines and jail time.

- Filing claims can cost you more – Insurance companies in Ohio generally give most affordable rates to insureds who do not file claims often. If you frequently file small claims, you can expect either policy cancellation or increased premiums. Insurance coverage is intended for claims that pose a financial burden.

Companies offer many discounts on Toyota Prius Prime insurance in Cincinnati

Some insurers don’t always list the complete list of policy discounts in a way that’s easy to find, so the following list contains a few of the more common and the more hidden discounts that may be available.

- Senior Citizen Discount – Drivers that qualify as senior citizens can possibly qualify for better insurance rates.

- College Student – Any of your kids who live away from home at college without a vehicle on campus can receive lower rates.

- Good Student – Being a good student can get you a discount of up to 25%. This discount can apply until age 25.

- Accident Forgiveness Coverage – Not really a discount, but some companies like Allstate and Progressive will let one accident slide before raising your premiums as long as you don’t have any claims for a certain period of time.

- Military Rewards – Being deployed in the military could trigger a small discount.

Please keep in mind that most discounts do not apply to the overall cost of the policy. Most only reduce specific coverage prices like comprehensive or collision. Even though the math looks like adding up those discounts means a free policy, it’s just not the way it works.

A list of insurance companies and a partial list of their discounts include:

- The Hartford offers discounts including defensive driver, air bag, vehicle fuel type, driver training, and bundle.

- American Family may have discounts that include defensive driver, multi-vehicle, good driver, good student, mySafetyValet, air bags, and accident-free.

- Progressive may offer discounts for continuous coverage, online quote discount, multi-vehicle, online signing, multi-policy, and homeowner.

- Travelers offers premium reductions for driver training, save driver, home ownership, IntelliDrive, payment discounts, multi-car, and multi-policy.

- Farmers Insurance includes discounts for distant student, youthful driver, electronic funds transfer, switch companies, bundle discounts, and alternative fuel.

- USAA policyholders can earn discounts including family discount, vehicle storage, new vehicle, loyalty savings, defensive driver, annual mileage, and multi-vehicle.

- Liberty Mutual discounts include newly married, new graduate, hybrid vehicle, good student, multi-car, exclusive group savings, and teen driver discount.

Before you buy a policy, ask every company what discounts are available to you. Some credits may not apply to policyholders everywhere. If you would like to see a list of insurers with discount insurance rates in Cincinnati, follow this link.

When to get professional advice

When it comes to a policy, there is no cookie cutter policy. Your situation is unique.

Here are some questions about coverages that might point out if your situation might need an agent’s assistance.

- Can good grades get a discount?

- Am I covered if my car is in a flood?

- Do I need to call my car insurance company before buying a new car?

- Who does medical payments coverage extend to?

- Why do I only qualify for high-risk insurance?

- Do I need PIP (personal injury protection) coverage in Ohio?

If you can’t answer these questions but you know they apply to you then you might want to talk to an agent. If you want to speak to an agent in your area, fill out this quick form. It’s fast, free and you can get the answers you need.

Insurance agencies near you

Many drivers would prefer to talk to a local agent and doing that can be a smart decision Agents can answer important questions and help you file claims. One of the benefits of comparing rate quotes online is you can get better rates but still work with a licensed agent. Buying from neighborhood insurance agencies is important particularly in Cincinnati.

By using this form (opens in new window), your information is sent to agents in your area who will give competitive quotes for your coverage. It simplifies rate comparisons since you won’t have to leave your computer because quoted prices will be sent to your email. If you have a need to quote rates from a specific insurance company, you would need to search and find their rate quote page and fill out their quote form.

By using this form (opens in new window), your information is sent to agents in your area who will give competitive quotes for your coverage. It simplifies rate comparisons since you won’t have to leave your computer because quoted prices will be sent to your email. If you have a need to quote rates from a specific insurance company, you would need to search and find their rate quote page and fill out their quote form.

If you would like to find a local agent, there are two different agency structures and how they can quote your rates. Agents are categorized either exclusive or independent agents depending on their company appointments. Either can sell auto insurance policies, but it is important to understand the subtle differences since it could factor into which type of agent you select.

Independent Agents

Independent agents are appointed with more than one company so they can write business with lots of companies and find you cheaper rates. If they find a lower price, your agent can switch companies which makes it simple for you. If you are comparing auto insurance prices, you will definitely want to get several quotes from at a minimum one independent agency so that you have a good selection of quotes to compare.

Listed below is a small list of independent insurance agencies in Cincinnati who may be able to give you competitive price quotes.

Huesman Schmid Insurance Agency, Inc

5670 Cheviot Rd – Cincinnati, OH 45247 – (513) 521-8590 – View Map

Rick Hensley Insurance Agency

747 Ohio Pike – Cincinnati, OH 45245 – (513) 797-8300 – View Map

Brodbeck Porter Ins Agency

1080 Nimitzview Dr #301 – Cincinnati, OH 45230 – (513) 624-0900 – View Map

Exclusive Insurance Agencies

Exclusive insurance agents write business for a single company and examples are State Farm, Allstate, and Farm Bureau. Exclusive agents are unable to shop your coverage around so they are skilled at selling on more than just price. Exclusive agents are well schooled in insurance sales which helps them compete with independent agents.

Shown below are exclusive insurance agencies in Cincinnati that can give you rate quotes.

Mike Schweppe – State Farm Insurance Agent

5956 Glenway Ave – Cincinnati, OH 45238 – (513) 922-1442 – View Map

Allstate Insurance: Marianne Geiger

4204 Plainville Rd – Cincinnati, OH 45227 – (513) 808-4811 – View Map

GEICO Insurance Agent

4081 E Galbraith Rd #1b – Cincinnati, OH 45236 – (513) 794-3426 – View Map

Picking the best insurance agency needs to be determined by more than just the price. These are some questions your agent should answer.

- How long have they been in business?

- Will you be dealing directly with the agent or with a Custom Service Representative (CSR)?

- Do they have adequate Errors and Omissions coverage? This protects you if they make a mistake.

- Do the agents have professional certifications like CPCU or CIC?

- Can you contact them at any time?

- Are they primarily personal or commercial lines agents in Cincinnati?

Cincinnati car insurance companies

Selecting the right car insurance provider is difficult considering how many different companies insure vehicles in Ohio. The information shown next may help you select which car insurance providers you want to consider when looking for cheaper rates.

Top 10 Cincinnati Car Insurance Companies Ranked by Customer Satisfaction

- USAA – 92%

- Erie Insurance – 88%

- American Family – 88%

- State Farm – 88%

- Nationwide – 88%

- 21st Century – 88%

- AAA Insurance – 87%

- Liberty Mutual – 87%

- Farmers Insurance – 87%

- The Hartford – 87%

Top 10 Cincinnati Car Insurance Companies Ranked by Customer Service

- Nationwide

- State Farm

- Safeco Insurance

- American Family

- Titan Insurance

- Travelers

- Liberty Mutual

- GEICO

- Erie Insurance

- Allstate

In conclusion

As you quote Cincinnati car insurance, never sacrifice coverage to reduce premiums. There have been many cases where an insured dropped liability coverage limits and discovered at claim time that it was a big mistake. Your focus should be to buy enough coverage at the lowest possible cost.

We just showed you a lot of tips how to lower your Toyota Prius Prime insurance car insurance rates in Cincinnati. The key thing to remember is the more companies you get premium rates for, the better your chances of lowering your premium rates. You may even be surprised to find that the lowest priced insurance comes from a small local company.

Consumers switch companies for any number of reasons including high prices, policy cancellation, high rates after DUI convictions and even extreme rates for teen drivers. It doesn’t matter why you want to switch switching companies is not as hard as you think.

How to buy lower priced Toyota Prius Prime insurance in Cincinnati

Really, the only way to find more affordable Toyota Prius Prime insurance in Cincinnati is to compare quotes annually from providers who provide auto insurance in Ohio.

- Read and learn about how insurance works and the things you can change to keep rates low. Many factors that result in higher rates like at-fault accidents, speeding tickets, and poor credit history can be rectified by being financially responsible and driving safely.

- Quote rates from independent agents, exclusive agents, and direct companies. Direct and exclusive agents can only provide price estimates from one company like GEICO or Allstate, while agents who are independent can provide price quotes from multiple sources. Find a Cincinnati insurance agent

- Compare the quotes to your existing policy to see if switching to a new carrier will save money. If you find better rates and buy the policy, make sure coverage is continuous and does not lapse.

- Provide adequate notice to your current company to cancel your current coverage and submit a down payment and signed policy application for the new policy. Once coverage is bound, put the proof of insurance certificate along with your vehicle registration.

One tip to remember is to compare the same physical damage deductibles and liability limits on every quote and and to analyze as many carriers as you can. This enables a fair price comparison and maximum price selection.

Additional information

- Uninsured Motorist Statistics (Insurance Information Institute)

- Who Has the Cheapest Cincinnati Car Insurance Quotes for a Ford Fusion? (FAQ)

- Who Has Cheap Auto Insurance Rates for Police Officers in Cincinnati? (FAQ)

- How Much are Cincinnati Car Insurance Rates for Nurses? (FAQ)

- Who Has Affordable Auto Insurance for Hybrid Vehicles in Cincinnati? (FAQ)

- How Much is Cincinnati Car Insurance for Postal Workers? (FAQ)

- Older Drivers FAQ (iihs.org)

- Choosing a Car for Your Teen (State Farm)

- Auto Insurance Basics (Insurance Information Institute)