It’s an obvious statement that auto insurance companies don’t want you to compare rates. Insureds who do rate comparisons are very likely to switch companies because there is a high probability of finding a lower-priced company. Surprisingly, a recent survey revealed that consumers who made a habit of comparing rates saved over $72 a month compared to policyholders who never shopped around.

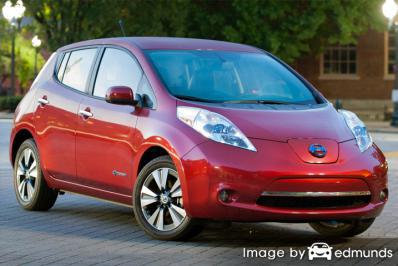

If finding discount rates on Nissan Leaf insurance in Cincinnati is your goal, then knowing the best way to compare insurance premiums can make it easier to shop your coverage around.

Truthfully, the best way to find low-cost Nissan Leaf insurance in Cincinnati is to begin comparing prices regularly from providers in Ohio. You can compare rates by following these steps.

Truthfully, the best way to find low-cost Nissan Leaf insurance in Cincinnati is to begin comparing prices regularly from providers in Ohio. You can compare rates by following these steps.

- Step 1: Gain an understanding of coverages and the measures you can control to prevent rate increases. Many policy risk factors that result in higher prices such as multiple speeding tickets and an imperfect credit score can be controlled by being financially responsible and driving safely. Read the full article for information to help prevent costly coverage and get additional discounts.

- Step 2: Quote rates from direct carriers, independent agents, and exclusive agents. Direct and exclusive agents can give quotes from one company like Progressive or State Farm, while agents who are independent can quote rates from multiple companies. View prices

- Step 3: Compare the price quotes to your existing rates and determine if cheaper Leaf coverage is available in Cincinnati. If you find a better price and make a switch, make sure coverage does not lapse between policies.

- Step 4: Provide adequate notice to your current company to cancel your current policy. Submit a completed policy application and payment for your new coverage. Make sure you store the certificate verifying coverage in your glove compartment.

One piece of advice is that you’ll want to compare the same amount of coverage on every quote request and and to get rate quotes from every company you can. Doing this guarantees a fair price comparison and a thorough selection of prices.

Getting a low cost price on Nissan Leaf insurance is not rocket science. All that’s required is to spend a few minutes on the computer comparing rates provided by online insurance companies.

Doing price comparisons online is so simple that it makes it obsolete to physically go to and from local Cincinnati insurance agencies. The fact that you can get quotes online has made agencies unnecessary unless you’re the type of person who wants the professional assistance that you can only get from talking to an agent. You can, however, price shop online and still use a local agent.

The companies shown below are our best choices to provide price comparisons in Cincinnati, OH. If your goal is to find cheap car insurance in Cincinnati, we suggest you visit as many as you can to get a more complete price comparison.

Why you need Nissan Leaf insurance in Ohio

Despite the potentially high cost of Nissan Leaf insurance, paying for car insurance is required by state law in Ohio and it also provides benefits you may not be aware of.

- Most states have minimum liability requirements which means state laws require a specific level of liability protection if you don’t want to risk a ticket. In Ohio these limits are 25/50/25 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $25,000 of property damage coverage.

- If you took out a loan on your vehicle, more than likely the lender will have a requirement that you have physical damage coverage to ensure they get paid if you total the vehicle. If you let the policy lapse, the lender will be forced to insure your Nissan at a much higher premium rate and force you to pay for it.

- Insurance protects both your assets and your Nissan Leaf. It will also cover medical expenses for yourself as well as anyone injured by you. One of the most valuable coverages, liability insurance, also covers all legal expenses up to the policy limit if you are sued as the result of an accident. If your Nissan gets damaged, comprehensive and collision coverage will pay to repair the damage minus the deductible amount.

The benefits of buying enough insurance definitely exceed the price paid, particularly if you ever have a claim. Despite what companies tell you, the average driver overpays as much as $800 each year so you should quote rates once a year at a minimum to ensure rates are inline.

Nissan Leaf Insurance Cost Factors

Many different elements are considered when you get your auto insurance bill. Some are pretty understandable like a motor vehicle report, although others are not quite as obvious such as your marital status or how financially stable you are.

- High credit rating translates to low premiums – Having a bad credit score can be a huge factor in determining premium rates. If your credit rating could use some work, you could pay less to insure your Nissan Leaf by improving your credit score. Drivers who have good credit tend to file fewer claims than drivers with lower credit scores.

- Vehicle theft costs us all – Driving a car with advanced anti-theft systems can help lower your premiums. Advanced theft deterrents such as vehicle immobilizer systems, OnStar, and tracking devices like LoJack can thwart car theft and help bring rates down.

- Reserve insurance claims for larger damages – If you file claims often, you can expect increased rates or even have your policy non-renewed. Auto insurance companies in Ohio award cheaper rates to people who are not frequent claim filers. Your car insurance is designed for more catastrophic claims.

- More policies can equal more savings – Lots of companies provide discounts to customers who carry more than one policy, otherwise known as a multi-policy discount. Even if you already get this discount, drivers will still want to compare other company rates to help ensure you have the lowest rates. You may still be able to save even more than the discount even if you have your coverage with different companies

- Insurance premiums and driver gender – Statistics show that women are safer drivers than men. This data doesn’t prove that females are better drivers. Females and males get in accidents at a similar rate, but the men cause more damage and cost insurance companies more money. Men also tend to get higher numbers of serious violations like driving under the influence (DUI).

- Don’t let your policy lapse – Allowing your insurance policy to lapse is a quick way to bump up your insurance costs. In addition to paying higher premiums, failure to provide proof of insurance will get you a fine, jail time, or a revoked license. You may then be required to prove you have insurance by filing a SR-22 with the Ohio motor vehicle department to get your license reinstated.

-

Insurance losses for a Nissan Leaf – Insurance companies use claims history as a way to help calculate a profitable premium rate. Vehicles that have increased claim numbers or amounts will have higher rates for specific coverages. The table below demonstrates the collected loss data for Nissan Leaf vehicles.

For each coverage type, the statistical loss for all vehicles averaged together is equal to 100. Numbers shown that are under 100 suggest a better than average loss history, while numbers above 100 point to more claims or larger claims.

Nissan Leaf Insurance Claim Statistics Vehicle Make and Model Collision Property Damage Comp Personal Injury Medical Payment Bodily Injury Nissan Leaf Electric 89 84 45 83 64 76 BETTERAVERAGEWORSEStatistics Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

When to get professional advice

When quoting and comparing coverage online or from an agent, there really is not a “perfect” insurance plan. Every situation is different.

Here are some questions about coverages that may help you determine if you might need professional guidance.

- Can I make deliveries for my home business?

- Why do I need rental car insurance?

- What is roadside assistance coverage?

- Who is covered when they drive my Nissan Leaf?

- Do I need to file an SR-22 for a DUI in Ohio?

- Does having multiple vehicles earn me a discount?

If you’re not sure about those questions but you think they might apply to your situation then you might want to talk to an insurance agent. To find an agent in your area, simply complete this short form. It’s fast, doesn’t cost anything and can help protect your family.

Cheaper auto insurance rates are out there

You just learned a lot of tips how to reduce Nissan Leaf insurance prices online in Cincinnati. The key concept to understand is the more providers you compare, the better your comparison will be. Consumers could even find that the lowest priced auto insurance comes from an unexpected company.

When you buy Cincinnati auto insurance online, it’s very important that you do not reduce needed coverages to save money. There are a lot of situations where an insured dropped collision coverage to discover at claim time that a couple dollars of savings turned into a financial nightmare. Your objective should be to get the best coverage possible at the best cost, but do not skimp to save money.

Lower-priced Nissan Leaf insurance in Cincinnati is attainable on the web and from local agencies, so you should be comparing quotes from both to have the best rate selection. A few companies do not offer online price quotes and usually these regional insurance providers prefer to sell through local independent agencies.

Even more information is located in these articles:

- Teen Driver Statistics (Insurance Information Institute)

- How Much are Cincinnati Car Insurance Rates for Business Use? (FAQ)

- How Much is Cincinnati Car Insurance for Welfare Recipients? (FAQ)

- Who Has Affordable Car Insurance Rates for a Chevrolet Equinox in Cincinnati? (FAQ)

- Safety Features for Your New Car (State Farm)

- How Can I Save Money on Auto Insurance? (Insurance Information Institute)